In a year defined by uncertainty, the construction market in the Pacific Northwest remained bullish in 2020. With solid supply chains still in place and general uncertainty about future market conditions, escalation rates hovered between 1% – 2%. This year has been a very different story, however, as several market factors have led to the steepest escalation rates seen in our market in more than 15 years. Ahead, we will cover a few of these factors, drawing from national data and our first-hand knowledge of the local market.

Seventeen labor agreements expired in 2021. Most of the new agreements resulted in three-year terms, with trades agreeing to 4% – 5% increases each year. Five more trade agreements are set to expire in 2022, including glaziers, elevator workers, drywall finishers, fireproofers and communication workers. We expect that each of these agreements will have similar results.

From cars to semiconductors, supply chains around the world are reeling in the wake of the pandemic — and the construction industry is not immune. In general, the cost of our primary materials for commercial construction — concrete, steel, wood, aluminum, and glass — have all experienced record escalation in 2021. Lumber price volatility garnered the attention of the public and news media outlets, with costs doubling between January and April before promptly dropping 64% in recent months. Though less widely reported, scrap steel pricing has drastically affected commercial construction projects across the country, impacting structural steel, metal decking, rebar, metal studs, HVAC equipment, ductwork, sprinkler piping, and more. Price increases for these materials range between 20% – 100% since January.

Fortunately, this volatility is rooted in a simple supply and demand challenge, and we project construction material pricing will eventually stabilize when supply catches up to demand. In the interim, we recommend closely monitoring pricing trends and locking in material pricing when the timing is right, even if it requires extra storage costs.

On most projects, 75% – 80% of total costs are attributed to subcontractors who are particularly vulnerable to the escalation caused by labor negotiations and volatile material pricing. These factors, combined with a strong construction market in the Puget Sound, have led to significant price increases on subcontractor and supplier bids.

Our advice for clients is to work with your general contractor to select key subcontractors as early as possible, leveraging their expertise, securing the best available teams, and locking in pricing at the optimal time.

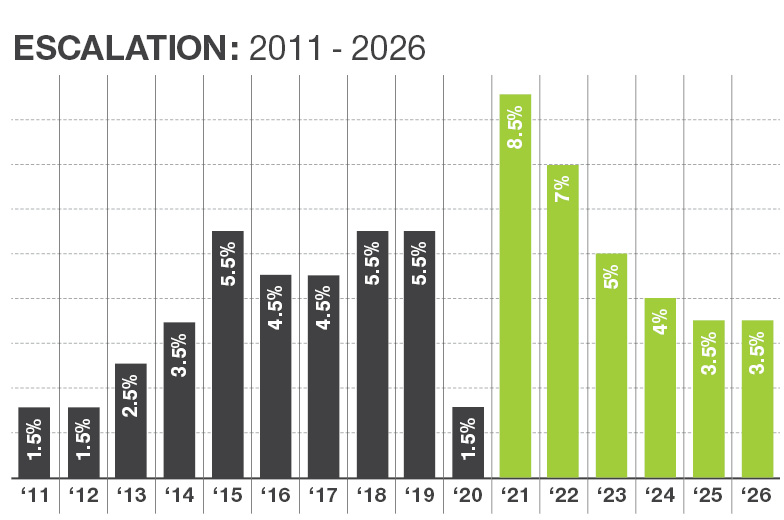

To put 2021’s sky-high escalation in proper context, we have included 10 years of historical data and five years of projections in the table below. In addition to labor negotiations, material pricing and subcontractor market conditions, these projections incorporate a wide range of macroeconomic and regulatory factors. We have analyzed each element through our unique local lens, drawing from 77 years of experience in the region.

The bottom line: The local construction market in the Pacific Northwest remains far more robust than much of the country. Contrary to the analysis of our national construction industry peers, Sellen does not anticipate a decline in commercial construction in our region for several years. We expect escalation to remain relatively high for the next few years before returning to more stable 3% – 4% rates in the years to come.

Industry Resources

- National Construction Inflation Report

- ENR Construction Economics

- RLB Construction Cost Report

- RS Means Construction Cost Index

Questions or concerns about how escalation and market volatility could impact your project in the Pacific Northwest? Sellen’s preconstruction team is here to help: info@sellen.com

Click here to read about the next topic: the impact of new code requirements.